All Categories

Featured

Table of Contents

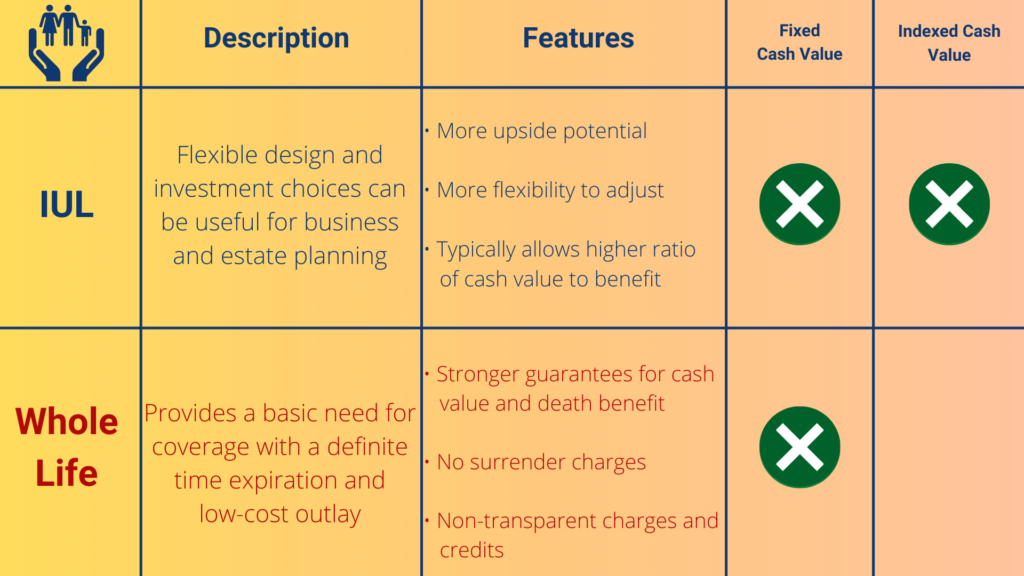

Removing agent payment on indexed annuities enables substantially higher illustrated and real cap prices (though still noticeably less than the cap prices for IUL plans), and no question a no-commission IUL policy would push detailed and actual cap rates higher also. As an apart, it is still feasible to have a contract that is very abundant in agent payment have high very early cash abandonment worths.

I will certainly acknowledge that it is at the very least in theory POSSIBLE that there is an IUL policy out there released 15 or 20 years ago that has supplied returns that are premium to WL or UL returns (a lot more on this below), yet it is necessary to better recognize what an appropriate contrast would involve.

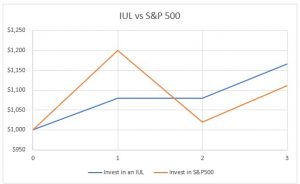

These policies usually have one bar that can be evaluated the company's discretion annually either there is a cap price that specifies the optimum crediting price in that particular year or there is an involvement price that defines what portion of any type of favorable gain in the index will certainly be passed along to the plan in that particular year.

And while I usually agree with that characterization based on the auto mechanics of the plan, where I disagree with IUL supporters is when they identify IUL as having remarkable go back to WL - cost of universal life insurance. Numerous IUL supporters take it an action better and factor to "historical" data that appears to support their cases

There are IUL plans in presence that carry more threat, and based on risk/reward principles, those plans should have higher anticipated and actual returns. (Whether they actually do is an issue for severe dispute yet companies are using this strategy to assist justify higher illustrated returns.) For instance, some IUL plans "double down" on the hedging method and assess an extra charge on the policy every year; this cost is after that made use of to boost the choices budget; and afterwards in a year when there is a positive market return, the returns are amplified.

Minnesota Life Iul

Consider this: It is feasible (and as a matter of fact most likely) for an IUL policy that averages a credited price of say 6% over its very first 10 years to still have a total unfavorable price of return during that time as a result of high costs. Many times, I discover that agents or customers that brag about the efficiency of their IUL plans are perplexing the credited rate of return with a return that correctly mirrors all of the policy bills too.

Next we have Manny's inquiry. He states, "My pal has been pressing me to get index life insurance policy and to join her business. It resembles a network marketing. Is this a good concept? Do they really make just how much they say they make?" Let me begin at the end of the inquiry.

Insurance salespersons are not bad individuals. I'm not recommending that you 'd despise on your own if you claimed that. I claimed I utilized to do it? That's exactly how I have some insight. I made use of to sell insurance coverage at the start of my profession. When they offer a premium, it's not unusual for the insurance provider to pay them 50%, 80%, also in some cases as high as 100% of your first-year premium.

It's tough to market since you got ta always be looking for the next sale and going to locate the next individual. It's going to be hard to discover a great deal of gratification in that.

Let's chat regarding equity index annuities. These things are preferred whenever the markets are in an unpredictable duration. You'll have surrender durations, usually seven, 10 years, possibly even beyond that.

Equity Indexed Life Insurance

That's exactly how they recognize they can take your money and go fully spent, and it will certainly be all right because you can not obtain back to your money until, once you're right into seven, ten years in the future. No issue what volatility is going on, they're probably going to be great from an efficiency point ofview.

There is no one-size-fits-all when it comes to life insurance./ wp-end-tag > In your busy life, financial independence can appear like a difficult goal.

Pension, social safety and security, and whatever they 'd taken care of to save. However it's not that easy today. Less companies are supplying conventional pension plans and lots of companies have minimized or ceased their retired life plans and your capacity to count exclusively on social protection remains in question. Also if advantages haven't been lowered by the time you retire, social safety and security alone was never ever intended to be adequate to spend for the way of living you desire and are entitled to.

Whole Life Index Insurance

Currently, that may not be you. And it is necessary to recognize that indexed universal life has a whole lot to provide people in their 40s, 50s and older ages, along with people who wish to retire early. We can craft an option that fits your details circumstance. [video: An illustration of a man appears and his wife and child join them.

This is replaced by an illustration of a document that reads "IUL POLICY - $400,000". The document hovers along a dotted line passing $6,000 increments as it nears an illustrated bubble labeled "age 70".] Now, suppose this 35-year-old man needs life insurance coverage to safeguard his household and a way to supplement his retired life income. By age 90, he'll have obtained practically$900,000 in tax-free revenue. [video: Text boxes appear that read "$400,000 or more of protection" and "tax-free income through policy loans and withdrawals".] And ought to he die around this time, he'll leave his survivors with greater than$400,000 in tax-free life insurance coverage benefits.< map wp-tag-video: Text boxes show up that read"$400,000 or more of security"and "tax-free earnings via plan lendings and withdrawals"./ wp-end-tag > In reality, throughout all of the buildup and disbursement years, he'll obtain:$400,000 or even more of protection for his heirsAnd the chance to take tax-free income with policy financings and withdrawals You're possibly questioning: Just how is this feasible? And the solution is easy. Passion is connected to the efficiency of an index in the stock exchange, like the S&P 500. The money is not straight spent in the supply market. Rate of interest is credited on a yearly point-to-point sections. It can give you much more control, versatility, and alternatives for your financial future. Like lots of people today, you might have access to a 401(k) or other retirement strategy. Which's a great primary step in the direction of saving for your future. Nonetheless, it is necessary to understand there are limits with certified strategies, like 401(k)s.

And there are constraints on when you can access your cash without fines. [video: Text boxes appear that read "limits on contributions", "restrictions when accessing money", and "money can be taxable".] And when you do take cash out of a qualified plan, the money can be taxable to you as earnings. There's a great reason so several people are turning to this special solution to address their monetary objectives. And you owe it to yourself to see how this can work for your very own personal scenario. As part of a sound monetary method, an indexed global life insurance policy plan can assist

Universal Life Insurance Cash Surrender Value

you tackle whatever the future brings. And it supplies special capacity for you to construct considerable cash money value you can make use of as extra income when you retire. Your cash can expand tax delayed via the years. And when the policy is developed properly, circulations and the death benefit won't be taxed. [video: Text box appears that reads "contact your United of Omaha Life Insurance company agent/producer today".] It is necessary to talk to a specialist agent/producer that comprehends how to structure a service like this properly. Before committing to indexed universal life insurance policy, below are some pros and disadvantages to consider. If you choose an excellent indexed global life insurance policy strategy, you may see your money worth expand in value. This is valuable because you may have the ability to access this cash prior to the strategy runs out.

Considering that indexed global life insurance policy requires a specific level of threat, insurance coverage business have a tendency to keep 6. This type of plan likewise supplies.

Commonly, the insurance company has a vested interest in executing far better than the index11. These are all variables to be thought about when choosing the best kind of life insurance coverage for you.

However, given that this sort of plan is extra complex and has an investment element, it can often feature higher premiums than other policies like entire life or term life insurance coverage. If you do not assume indexed universal life insurance coverage is right for you, below are some options to think about: Term life insurance policy is a short-term policy that usually uses protection for 10 to thirty years.

Variable Universal Life Insurance Calculator

Indexed universal life insurance policy is a kind of policy that uses more control and adaptability, in addition to higher money worth growth possibility. While we do not offer indexed global life insurance, we can offer you with even more details about whole and term life insurance policy policies. We recommend checking out all your alternatives and talking with an Aflac agent to discover the finest fit for you and your family members.

The rest is added to the money value of the plan after fees are deducted. While IUL insurance might verify important to some, it's vital to understand how it works before buying a policy.

Latest Posts

Universal Life Tax Shelter

Universal Guaranteed Life Insurance

Single Premium Indexed Universal Life Insurance